Replay (Asia) : Insurer CEO Fireside Chat: Understanding the Transitioning Commercial Insurance Marketplace

On 12 November, Marsh invited leaders from across the insurance industry to discuss what was driving pricing and coverage changes, and how businesses can generate better outcomes for upcoming renewals.

Moderator:

John Donnelly, Marsh Global Placement Leader, Asia and Pacific

Panelists:

Marsh - David Jacob, CEO Asia

QBE Insurance - Lei Yu, CEO, North Asia & Regional Head of Distribution, Asia

Chubb - Paul McNamee, Senior Vice President, Chubb Group & Regional President, Asia Pacific

Allianz Global Corporate & Specialty - Mark Mitchell, Regional Managing Director, Asia Pacific

Zurich Insurance - Reginald (Reg) Peacock, CEO, Singapore Branches & Head of Commercial Insurance, Asia

Overview

John Donnelly opened by discussing current conditions:

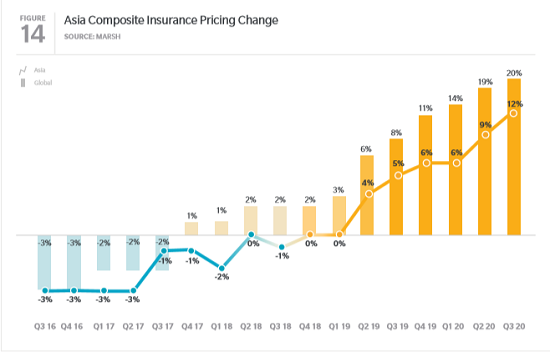

Asia’s commercial insurance pricing increase for Q3 year-over-year sees Asia at 12% compared to 20% globally. The increases are mainly from international insurers, resulting in wording restrictions and coverage wind backs with sub-limits reduced.

Underwriters have reduced appetite for catastrophe risks and this trend is expected to continue into 2021 along with an increased focus on policy coverage.

At the heart of such conditions is the reduced profitability of insurers and reinsurers due to losses in recent years from:

- Reduced prices (soft market).

- Several natural catastrophes in North America, Asia and Pacific.

- Low interest rate environment with low returns on investments.

As such, the cost of reinsurance is rising, which causes an upward pressure on insurance premiums.

Green Shoots:

- Housecleaning underway with many insurers changing their strategies to their products and portfolios.

- New capital attracted to startups and smaller underperforming companies due to legacy and capital issues getting relaunch.

- Insurers’ underlying loss ratio are improving, thus demonstrating their strategies will deliver results and they are in better shape for profitability.

Insights from David Jacob, Marsh

Brokers have a vital role: With the market already hardening pre-Covid, brokers help clients think about their buying patterns and offset impacts of current market conditions. Clients are starting much earlier renewals and learning a lot about the value of long-term relationships with brokers and insurers that are bringing home dividends.

Massive flight to quality: Businesses are now looking at what they absolutely need. They are focusing on analytics and optimizing use of risk advisory and risk engineering to differentiate the risk they bring to insurers, as capacity is constrained.

Insurers wants to see the best risk mitigation in place. To get a better deal from the market in these trying times:

- Think about risk and not necessarily insurance.

- Take more time to prepare for renewals, do the analysis, prioritize with different options around cost.

- Lean on existing partners but also have an open view of what options to table.

- Leverage brokers to make your risk “Class A” and differentiate from every other risk going to insurers.

Insights from Reginald Peacock, Zurich

Zurich has a strong balance sheet and good combined ratios due to their 3-year strategy:

- Cut out unproductive and value-destroying cost (US$1.5 billion) to focus on delivering to customers.

- Focus on underwriting excellence.

Risk Engineering an important tool: Although not comprehensively embraced in Asia, risk engineering can help clients improve their risk and control cost of risk transfer.

Consider Alternative Risk Transfer (ART) and Captive solutions: Insurers have tried-and-tested (in other regions) solutions that can be delivered to Asia. In Europe and Australia, there has been a lot of increased activity in Captive and ART. In Asia, Zurich is spending a lot of time communicating these solutions. The machines are ready to deliver, but we need people to understand the opportunity. We feel some momentum building, and expect a lot more execution in 2021, but the traction now is limited.

David Jacob noted as brokers, he is seeing an influx of enquiries, and it makes sense; the current hard market has made many clients rethink alternative measures and how to better use capital through use of captives or Risk Finance Optimization.

Insights from Lei Yu, QBE

For QBE, it has been 18 months since Asia and Europe were added to the international division. QBE is very strong in Europe, especially in the Specialty classes, and the combined division is exploring new products such as Parametric insurance and enhancing current offerings like Multinational capabilities.

While knowledge is better shared and expertise from Europe is seamlessly delivered to Asia, both regions maintain different appetite statements. In many areas, Asia continues to have a broader risk appetite, like in Project PI and Renewable Energy, but leverages Europe’s expertise in Marine PI, Financial Lines, Cyber, Construction and Trade Credit.

Distribution focus areas in 2021: We are looking at growing the wholesale business in Japan, Korea, Greater China, Thailand and ASEAN countries, because we think the rating environment is correct for us.

Specific growth areas: Financial Lines and Retail sectors, and certain Property and Liabilities areas that had historically had too low rates but now having more sustainable rates for consideration.

Insight from Paul McNamee, Chubb

In Asia, we have some unique dynamics in play:

- Significant local capital that looks for lower returns as return hurdles are much lower due to low interest rates.

- Cheap and indiscriminate reinsurance capacity and wholesale insurers that are transient: they provide lots of capacity in short term but leave when their P&Ls start looking risky.

- Tariff pricing in the region (e.g. Malaysia, Indonesia, Thailand, Taiwan): These artificially keep prices high and provide margins for insurers to depress loss ratios and increase acquisition cost.

These unique characteristics attract capital and provide margin, so Asia experiences higher premium rate erosion than other regions over the years. Viewed from another angle, Asia has been enjoying significant rate changes for the last 20 years before this recent hard market.

- E.g. Casualty prices in Asia today versus 15 years ago are overall 50% lower, and 20% lower when compared to 5 years ago. Generally speaking, pricing is well below what it was 15 years ago. This is similar for Financial, D&O, Property and PI.

Current macro marketplace trends likely to endure through 2021: However, including our competitors, there are green shoots of improved performances globally. The main thing insurers can do is to have empathy for customers and be consistent: offer capacity to customers. Prices may not be low, but at least we are stepping in and being there when others leave.

Insights from Mark Mitchell, Allianz

Allianz will focus on underwriting excellence. The mid to longer-term benefits for clients in a number of areas are:

- Contract certainty due to global standardization.

- Focus on risk mitigation from client’s perspective: Allianz is buying predictive models to assist in predicting trends in recall claims.

- More stable pricing environment due to investments in technical pricing tools.

With Allianz’s renewed focus on industry specialization, clients can expect Allianz to have a deep understanding of customers’ risk and insurance needs.

The initial focus for 12–18 months: Financial institutions, telco and IT, construction.

Thereafter: Power & utilities, aviation & aerospace, transportation.

Q&A Session

How can we develop and encourage risk handling and transfer maturity through parametric and ART?

John Donnelly: With parametric and ART, capacity is limited so in most circumstances they cannot replace existing programs, rather they are used to augment or support cat-type risks.

We typically see insurers competing with each other for small parametric deals rather than working together for bigger and better solutions for clients. However, I can see this market developing with a longer hard market.

There has been a trend of removing Covid/communicable disease extensions for Business Interruption covers. What kind of commitments can we have from insurers to resist this trend?

Paul McNamee: We have to look at the original intention of these extensions—they were to provide coverage for a limited geography and time for say, a measles outbreak or a landslide disruption, and that was always the intention of the coverage. It was never either the customer’s or insurer’s intention to purchase or provide cover to an open-ended catastrophic scenario unbound by geography.

Covid-19 has taught us that this is the open-ended nature of such a catastrophe. But for insurers, I think what we are seeing is a reaction against having an open-ended scenario with a finite balance sheet and what seems at the moment an infinite amount of loss.

Insurers typically review renewals 2 months before the renewal process. How then do we start an early renewal process of about 6–8 months prior?

John Donnelly: The process starts with a review of the organization’s risks and planning what needs to be bought and hence there are no interactions with the markets at this stage. This process should start early, around 6-8 months before renewals.

As David Jacob concluded, there is massive empathy for what we are all going through and if we work together collectively, we can get through this difficult period. In summary, we have to be much more prepared, look at many options and hopefully we can offset some of the premium increases with more innovation with how we look at your programs.