In February when we launched Marsh’s Political Risk Map 2017, a number of events were setting the stage for geopolitics in the coming year: elections in Europe and elsewhere, the shaping of American policies — foreign and domestic — under President Trump, internal strife in numerous countries, and the path to Brexit, to name a few. Since then, some of these have unfolded as many predicted they would, others took a different tack, and new issues came to the fore.

For example, the rise of nationalism/populism that appeared poised to sweep Europe did not extend to much-watched elections in Austria, France, and The Netherlands, but the potential for disruption remains, with elections upcoming in Italy. At the same time, risks in other regions have come into starker focus. Tensions have flared between North Korea and the US, while unrest in several Latin American countries has continued to make international headlines.

To help multinational organizations be aware of political and economic risks worldwide, Marsh annually shares the independent analysis of BMI Research, a leader in providing multinationals, governments, and financial institutions with impartial forecasts, data, and analysis to guide critical strategic, tactical, and investment decisions. This year, Marsh has partnered with BMI Research to provide an additional update on BMI Research’s Country Risk Index (CRI) scores, which form the basis of Marsh’s Political Risk Map.

Updated country scores can be viewed at the Marsh Political Risk Map 2017, and are based on BMI Research’s CRI, which assesses each country’s economic, political, and operational environment.

Considering both short- and long-term risks to stability — economic and political — as well as operational risks to the business environment, the index provides cross-country comparisons on a global basis. Under BMI Research’s method, the maximum CRI number for a country is 100 — the higher the index, the less political risk.

The following is a summary of countries that have experienced notable changes since February in their short-term political risk scores (STPRI), the element of the overall CRI that shows recent changes in the level of political risk. We have focused on STPRI as it was the factor that, since the last update, was likely to be the biggest contributor to overall CRI movement in countries that experienced significant change.

NORTH AMERICA

The US STPRI score was reduced from 86.7 to 85, due to concerns regarding domestic politics and the potential for a broader geopolitical conflict. And, notably, since BMI Research’s 2017 update, US relations with Russia and North Korea have deteriorated, with threats from North Korea regarding its nuclear weapons capability and strains in US relations with Russia due to allegations of tampering in the US presidential election, new sanctions against Russia, and a reduction by Russia in the number of US diplomats allowed in the country.

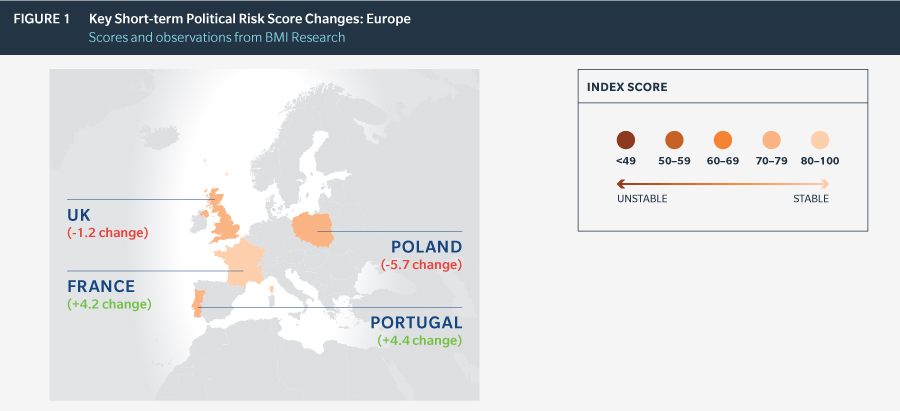

EUROPE

France’s STPRI improved from 76.0 to 80.2 since the last update, following the victory of Emmanuel Macron over the far-right candidate Marine Le Pen in the May presidential elections. Portugal’s STPRI improved from 70.0 to 74.4 due to the reduced likelihood of an early election and confirmation from the EU1 that the economy continues to recover from the worst recession in memory.

Ongoing tensions with the European Commission due to legislative differences have led to decreased stability in Poland, for which the STPRI fell from 76.5 to 70.8. Meanwhile, in the UK, uncertainty surrounding Brexit deepened following a snap general election in June that led to the formation of a minority government, resulting in a fall in its STPRI from 78.3 to 77.1.

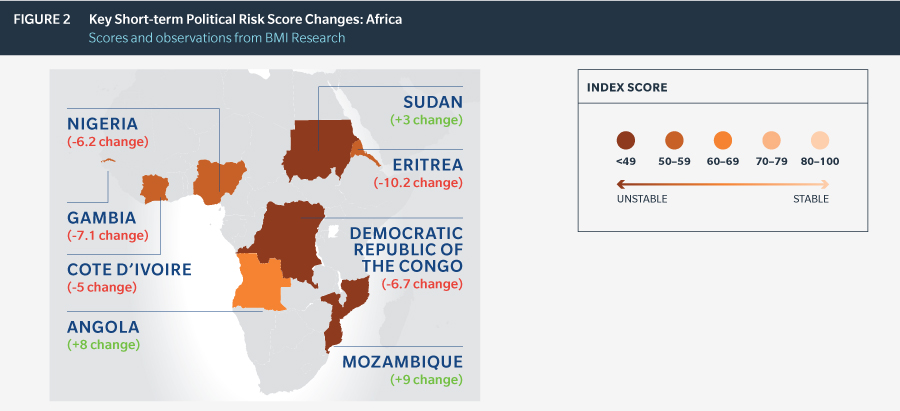

AFRICA

There have been some notable improvements in the region since the last update; however, Africa still includes some of the world’s most unstable countries. BMI Research raised its STPRI score for Sudan from 35.8 to 38.8, following the easing of trade and financial sanctions from the US in response to the country stepping up efforts to fight radical Islamist groups.

Other countries with notable improvements in STPRI include Mozambique (from 38.5 to 47.5), following a ceasefire between the ruling FRELIMO party and the RENAMO opposition party and rebel movement; and Angola (from 59.4 to 67.5), after the smooth transition from former president Eduardo dos Santos to his chosen successor, defense minister Joao Lourenco, in August 2017.

However, instability remains with political uncertainty negatively impacting STPRI scores in Gambia (from 62.5 to 55.4), Nigeria (from 56.0 to 49.8), the Democratic Republic of the Congo (from 32.7 to 26.0), and Eritrea (from 67.3 to 57.1). In addition, following mutinies by former rebel soldiers, Cote d’Ivoire’s STPRI score fell from 62.7 to 57.7.

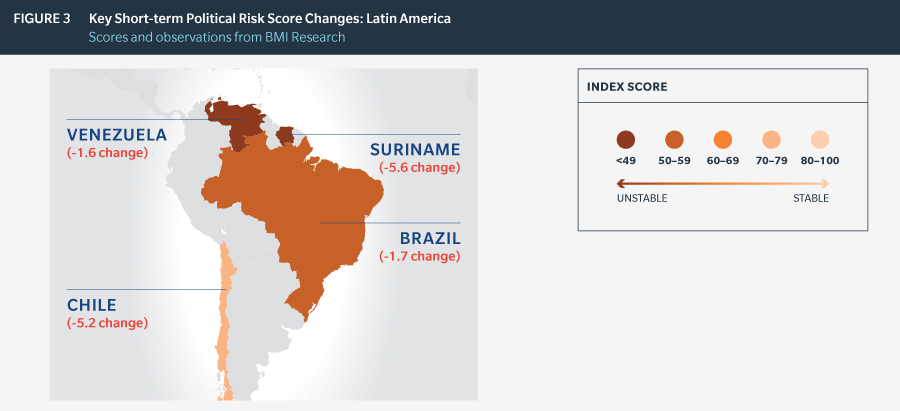

LATIN AMERICA

Several countries in the region are experiencing periods of unrest and economic austerity, which have had a negative impact on their political, economic, and country risk index (CRI) scores. The STPRI was reduced in both Venezuela, from 35.0 to 30.6, and Suriname, from 52.9 to 47.3. Political gridlock and rising unemployment has caused Chile’s STPRI score to fall from 75.8 to 70.6.

Meanwhile, Brazil’s STPRI was reduced from 59.2 to 57.5 amid allegations of corruption surrounding President Michel Temer, however, on August 2 opposition lawmakers in the lower house of Congress failed to obtain the two-thirds majority needed to send the case to the Supreme Court.

MIDDLE EAST

Qatar has been under a political and economic blockade led by Saudi Arabia since early June. The diplomatic crisis between the country and Saudi Arabia, the United Arab Emirates, Bahrain, and Egypt shows little sign of abating and remains a key political risk in the region.

Islamic State (IS) has been removed from its de facto Iraqi capital of Mosul, and BMI Research predicts IS will be defeated in Iraq in the second half of this year. While Iraqi Prime Minister Haider al-Abadi has declared that one half of the so-called caliphate has fallen, there is still foundation for continued concerns

ASIA

Tensions between North Korea, its neighbors, and the US may be the most pressing risk in the region. However, ongoing disputes between China and several East Asian nations over territories in the South China Sea persist. In the Philippines, the threat posed by IS has contributed to a reduction in the country’s STPRI score from 64.6 to 63.1.

Pakistan is in the midst of political turmoil following the removal of former Prime Minister Nawaz Sharif over allegations of corruption. New US sanctions against Russia continue to impact political risk in the region. Uzbekistan saw one of the most notable STPRI improvements in the region, rising from 50.8 to 56.0. This follows the smooth transition to new president Shavkat Mirziyoyev following the death of former president Islam Karimov in late 2016.

PACIFIC

The Pacific region remains relatively stable. New Zealand’s general election took place on 23 September, although neither side secured enough seats to form a majority. In anticipation of this, BMI Research lowered the island nation’s STPRI from 84.0 to 82.7.

ABOUT THE POLITICAL RISK MAP 2017

The Political Risk Map 2017 presents a global view of the issues facing today’s multinational organizations and investors. It shares data and insight from BMI Research — a leading source of independent political, macroeconomic, financial, and industry risk analysis.

This interactive map rates countries on the basis of political and economic stability, giving insight into where risks are most likely to emerge and key concerns for organizations in the countries in which they do business. BMI Research provides short- and long-term political and economic scores up to a maximum of 100, with higher scores denoting greater stability. It also looks at “operational” risks, which include measures related to labor markets, trade and investment, logistics, and crime and security (including terrorism), and provides an overall country risk score, which takes the full spectrum of risk factors into consideration.

The assessments in the map are solely made on the basis of BMI Research’s independent research and knowledge of world events. For more information about BMI Research, visit their website.