Wealth at Risk: How High Net Worth Families Overpay to be Underinsured

Independent insurance agents and brokers frequently find that families with substantial assets who insure their homes, autos, watercraft, and valuable collections with mass-market, heavily advertised carriers overpay for protection that still leaves them exposed to severe financial loss. What are the specific risks, and why are these high net worth (HNW) families paying more than necessary?

To find out, ACE Private Risk Services surveyed more than 600 independent insurance agents and brokers in 2010 and again in 2012 about their new HNW clients who were previously insured by a mass-market carrier. The survey asked if the clients were likely overinsuring or underinsuring for 21 types of coverage. It also asked about the likelihood of 11 types of savings opportunities being missed.

A Widespread and Worsening Problem

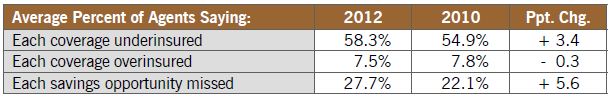

The agents’ answers reveal that the problem of overpaying to be underinsured has worsened overall. On average, significantly more agents in 2012 than in 2010 said each type of coverage was likely underinsured and each savings opportunity was likely missed.

Top Areas of Overpaying

Having deductibles that were too low, failing to earn package discounts, and not getting premium credits for alarm systems and other loss prevention devices continued to top the list of missed savings opportunities. The likelihood of missing the last two increased significantly from 2010 to 2012.

Top Areas of Underinsuring

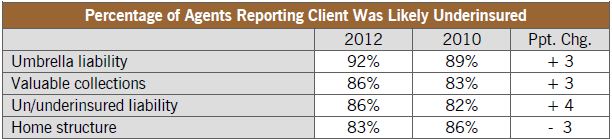

Coverage for umbrella liability, valuable collections, uninsured/underinsured liability, and rebuilding a damaged home remained the most likely underinsured risks.

Because families with substantial assets overlook many savings opportunities, most agents say they can typically rebalance a family’s personal insurance program to achieve more effective protection without significantly increasing premiums. Read the full white paper written by ACE Private Risk Services.