Global Insurance Market Quarterly Briefing — May 2015

Decreases in insurance rates were seen across regions and in most major lines of business, with cyber insurance a notable exception.

In insurance lines, property showed the largest rate declines, on average, across all regions in the first quarter, led by Continental Europe and Asia Pacific.

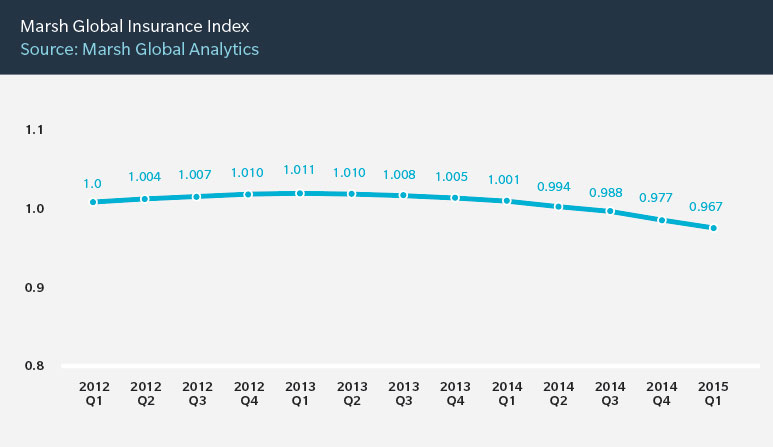

The first quarter of 2015 saw global commercial insurance rates decrease, on average, compared to the same period a year ago. This eighth consecutive quarter of declines was driven in large part by an oversupply of capital, a dynamic supported whether looking at the growth in insurer surplus levels or the increased capacity deployed in new geographies and products.

Coupled with strong underwriting performance, this overcapitalized position is behind the softening market. In both the insurance and reinsurance markets, consolidation accelerated over the last several quarters. The trend, which is expected to continue, is a clear sign that the industry is experiencing excess capital levels.

According to the report:

- Asia-Pacific experienced the largest composite rate decrease, followed by Continental Europe, the UK, Latin America, and the US.

- Cyber insurance in the US was one of the few areas where average rates increased. Rate levels have been generally increasing, even for companies without meaningful cyber losses to date.

- The Marsh Global Insurance Index stood at 0.967 in the first quarter of 2015, down from 0.977 in the previous quarter.

The report also examines components of the insurance pricing environment: capital committed to the market, insurer profitability, and insurer pricing methodologies.