School Councils, Societies And Parent Groups Insurance Program

Increasingly, parents are taking on more active roles in the schools their children attend, particularly with respect to fundraising. The activities of parent groups, councils or societies may or may not be covered under their respective school boards’ liability insurance policies. In cases where activities are run independently, without direct oversight of a school employee or trustee, these parent groups may require their own liability insurance protection.

Your School Board’s insurance offers coverage as long as your school society or parent group is acting within its mandate as defined in the Alberta and Saskatchewan School Act. If you are involved in activities that are not under direct control of your school or board administration your group may be required to purchase insurance.

Marsh Canada Limited can offer parent groups access to an insurance program that is designed to meet

the unique needs of these types of organizations.

This program features competitive rates and includes:

- Commercial General Liability Insurance

- Directors and Officers Liability Insurance

- Crime Insurance

- Contents Insurance

A School Board’s liability insurance does not extend to a society or parent group and its directors as the society is its own legal entity, separate and distinct from the school board. Even though the societies

and parent groups are acting on behalf of the board, the board does not directly control their activities. A society has their own executive which makes decisions on behalf of the group.

Societies and parent groups may choose to purchase their own liability insurance. The exposure to risk of liability can best be reduced by practicing good management of the society’s activities.

Commercial General Liability Insurance

Commercial general liability insurance protects your group in the event of an accident. The policy covers your organization for claims arising from bodily injury or property damage to third parties that arise from your group’s activities. Casinos, fundraising, incorporation under the society act and playground builds are covered. Coverage of $5 million or $10 million is available under this program.

Directors and Officers (D&O) Liability Insurance

Directors and officers liability insurance protects the group, its officers and other volunteers for any breach or alleged breach of duty or wrongful act while acting within the scope of his or her duties. Coverage of $2 million or $5 million is available under this program.

Crime Insurance

Crime insurance policies, which are often referred to as fidelity bonds, protect organizations from direct financial loss arising out of dishonest and fraudulent acts committed by their members as well as specific types of fraudulent or criminal acts committed by non-members, including theft, burglary, robbery, forgery, fraud, and computer theft. Our program covers your group up to a limit of $25,000. Option coverage limit increases to $50,000 or $100,000 are also available.

Contents Insurance

Contents insurance covers your group in the event of losses related to items or equipment that are owned by your group up to $10,000 in value.

Program Details

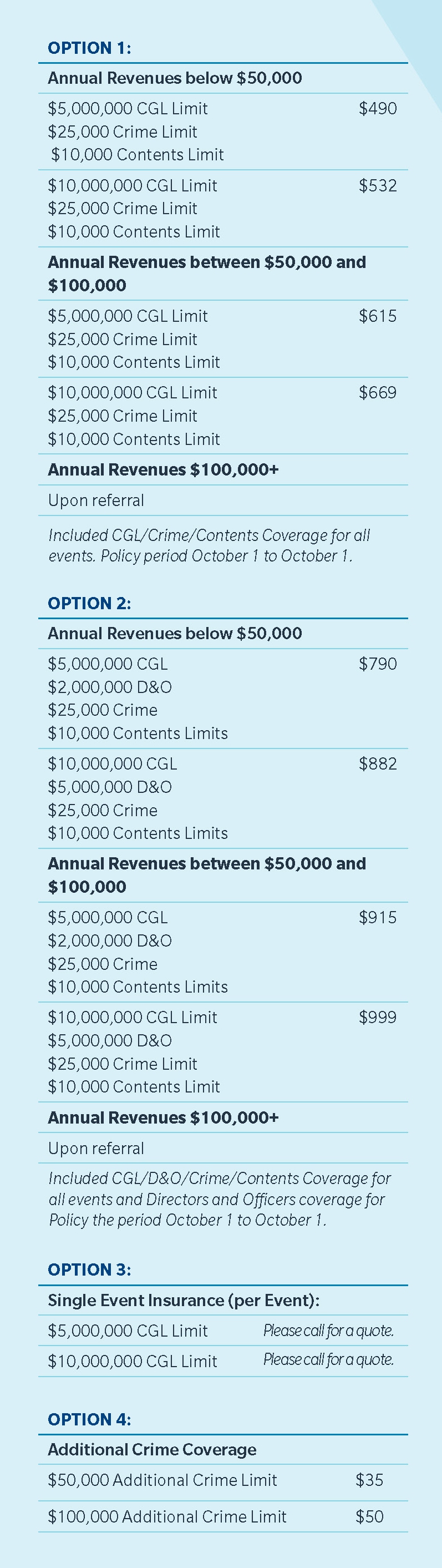

The options below, outlines the various coverages available and the annual cost for the coverage options available under this program.

Program Limits and Premiums Options: