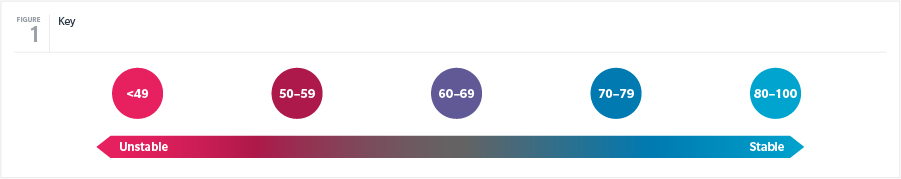

- Stable

- 80-100

- 70-79

- 60-69

- 50-59

- <49

- Unstable

- No Data

Click on a country for further analysis. Risk scores and commentary provided by Fitch Solutions.

Businesses have arguably never faced such a breadth of challenges as they do today. From emerging economies to mature ones, business and trade are increasingly susceptible to uncertainty, with political risks posing a threat to their business interests.

Rising geopolitical and geo-economic tensions represent the “most urgent global risks at present”, according to the World Economic Forum’s Global Risks Report 2019. Marsh’s Political Risk Map 2019, based on data from Fitch Solutions, highlights changes from last year and looks ahead to ongoing risks, including continuing US-China tensions, trade wars, Brexit and changes within the Eurozone, the future of Iran’s and North Korea’s nuclear programs, and tensions between Russia and the West.

Transition to a more multi-polar world order of protectionism is likely to continue. While the US, China, Russia, and to a lesser extent the EU and Japan, will remain the most powerful actors, emerging powers such as India, Iran, Saudi Arabia, Turkey, and Brazil will be increasingly important players.

The US and China are intensifying their geopolitical competition in the Indo-Pacific region and, with both stepping up military activities in the South China Sea, an unintended military clash is possible. Meanwhile, Russia’s relations with the West will remain tense in 2019 as a result of the Kremlin’s alleged interference in US and EU domestic politics, the Skripal poisoning incident in the UK, laboratory hacking in Switzerland and conflicts in Syria and Ukraine. All of this could lead to more US and/or EU sanctions on Russia. US President Donald Trump’s withdrawal from the 1987 US-Soviet Intermediate-Range Nuclear Forces Treaty also raises the possibility of a new missile build-up in Europe.

As Fitch Solutions note, 2019 will be a busy year for elections in emerging markets and some developed states — which could heighten the climate of political volatility. We consider these further in our regional analysis.

Uncertainty ahead

Isolationist and protectionist sentiments and practices have risen in some countries, halting, at least momentarily, the process of globalization. Actions in one economy create reactions in others. Against this backdrop, it could prove more difficult for nations to make collective progress on global challenges.

Global trade is increasingly afflicted by uncertainty, with perhaps the biggest current cause being the ongoing trade dispute between the US and China. An export-heavy economy such as Germany is inevitably impacted. This uncertainty is compounded by Brexit, the exact nature and effects of which are still unclear. At the same time, there is a “fear factor” rippling through the global economy and, in some cases, there has been a retrenchment of liberal values and a political shift to the right.

Economic uncertainty can play out socially and politically, and can easily change form and spill across continents. For example, disruptions to supply chains and/or economic slowdowns in individual countries may well be felt far beyond their own borders. More than ever, political risks in one part of the world or sector are likely to spill over into other regions or sectors, often causing unexpected harm.

In the following article, we use Fitch Solutions’ data to look at many of the country-specific political risks that companies may face in 2019. What is most noticeable today is how many of the macro threats are in so-called developed economies as opposed to emerging markets. Vigilance and broad, systemic risk analysis will be vital to minimizing these risks.

North America

The Democrats’ capture of the House of Representatives in the 2018 mid-term elections is likely to lead to a more combative US political landscape in 2019. It has already seen the longest shutdown of government in American history. A more activist House could launch investigations into perceived wrongdoings by President Trump or others. Candidates are already announcing for the 2020 Democratic presidential nomination while, with a divided Congress likely to hold up policy formation and enactment, President Trump’s focus is likely to center on foreign policy, where the executive has more leeway than on domestic policy.

Trade tariffs and geopolitical disputes with China could escalate in 2019, bringing the risk of further Chinese retaliation and US counter-retaliation. In addition, Trump's re-imposition of sanctions on Iran in November 2018 risks generating a tougher stance by Tehran, potentially raising the risk of conflict, or the start of a new rapprochement.

Another focus will be to ensure that the rapprochement with North Korea remains on track. In Washington, meanwhile, the ongoing investigations into President Trump’s alleged ties with Moscow might prevent him from undertaking initiatives that could improve bilateral relations with Russia, Fitch Solutions noted.

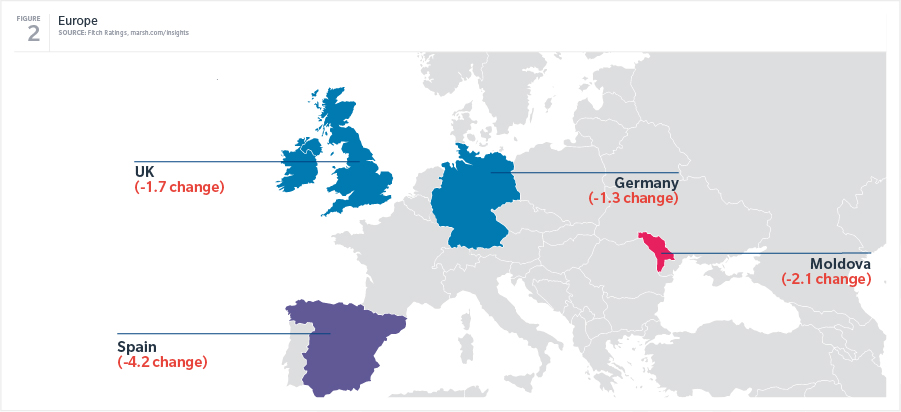

Europe

The UK's politics in 2019 and beyond will remain focused on Brexit negotiations and subsequent transition period out of the EU. Brexit aside, the EU will be in a state of transition in 2019 as it prepares for parliamentary elections in May and new presidents of the European Commission and European Central Bank, and European Council, in November and December respectively.

Elsewhere, the possibility that German Chancellor Angela Merkel may step down early, rather than serve out her full term to Germany's autumn 2021 general elections, means that the EU could face a leadership vacuum. French President Emmanuel Macron could possibly seek to fill the void, but his declining popularity at home may mean that his attention is focused on domestic matters.

Meanwhile, the Ukraine conflict could worsen, especially if President Petro Poroshenko or his successor seeks to bolster nationalism in an election year and Russia responds. Elsewhere, Moldova’s general elections in February 2019 could turn the country into another diplomatic focal point, with the pro-Western government pitted against the pro-Russian opposition.

In Spain, the People’s Party government of Prime Minister Mariano Rajoy collapsed in June, and was replaced by a minority socialist administration with very little parliamentary support. There was also continued unrest in Catalonia. As a result, Fitch Solutions lowered Spain’s short-term political risk index (STPRI) from 68.3 in 2018 to 64.6 in 2019, the largest reduction in the continent. A lower STPRI score represents decreased stability and is one piece of Fitch Solutions’ overall political risk index score.

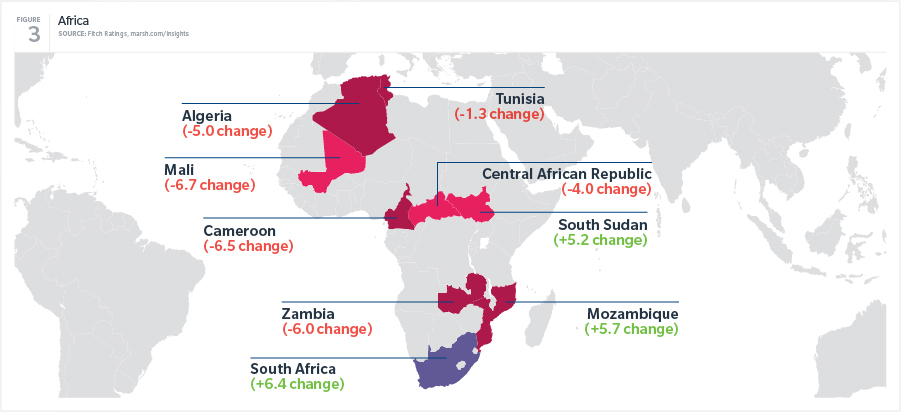

Africa

The African region once again saw some of the biggest improvements in political risk, and also some of the most notable deteriorations, according to Fitch Solutions. The STPRI scores in South Africa, Mozambique, and South Sudan all improved. In South Africa, the resignation of President Jacob Zuma and his replacement by the pro-reform Cyril Ramaphosa in February 2018 ended a period of large public protests. Mozambique made progress toward a peace deal between the ruling Frelimo party and the rebel Renamo organization, while in South Sudan a peace deal was signed between President Salva Kiir Mayardit and rebel leader Riek Machar.

Fitch Solutions decreased STPRI scores considerably in Zambia, Mali, Algeria, Tunisia, Cameroon, and the Central African Republic. Zambia saw growing social tension over rapidly deteriorating economic conditions and public concern about rising debt levels, with opposition groups seeking the impeachment of President Edgar Lungu. Mali experienced increased social unrest in the wake of the August presidential elections, as well as persistent ethnic conflict and insurgencies in the centre and north of the country. In Algeria, meanwhile, there is rising uncertainty over the 2019 presidential election.

Tunisia saw the collapse of the coalition between President Beji Caid Essebsi's Nidaa Tounes party and the Ennahda party. This will make policy-making difficult ahead of parliamentary and presidential elections late in 2019. In Cameroon there was some discontent over the October 2018 re-election of President Paul Biya and the postponement of planned municipal and legislative elections to 2019. In the Central African Republic, the humanitarian environment deteriorated further while a power struggle between armed groups continues, increasing the possibility of a return to large-scale violence between Muslims and Christians.

Latin America

Fitch Solutions data indicates that political risks in several Latin American countries have improved, with Guatemala, Chile, and Paraguay seeing the biggest positive movement in their STPRI scores. Guatemala’s index measure improved as President Jimmy Morales attained more support from Congress and the establishment than in 2017, while avoiding large-scale protests. In Chile, the December 2017 election of President Sebastian Pinera ended a period of uncertainty, with economic improvement and lower unemployment. Meanwhile, Paraguay experienced improved clarity on policy and an easing of social tensions following the election of President Mario Abdo Benitez in April. However, Fitch Solutions reduced Nicaragua’s score significantly as President Daniel Ortega faced massive protests against his rule in 2018. The situation on the ground could remain volatile for the foreseeable future. Inflation in Venezuela is anticipated to reach 10,000,000% in 2019, while the new political scenario — with Juan Guaidó, President of the parliament, being recognized by many countries as the interim president — increases uncertainty over the country’s future.

Middle East

While the balance of power in Syria has shifted in favour of President Bashar al-Assad, a peace settlement appears unlikely in the immediate future. The conflict poses the risk of a clash between the Russian and US militaries. Any clash involving ‘official’ troops would be dangerous and could escalate into a major crisis. Iran faces a particularly challenging 2019 as it marks the 40th anniversary of the Iranian Revolution in February. Its economy is deteriorating due to the Trump administration’s withdrawal from the Joint Comprehensive Plan of Action (JCPOA — the Iran nuclear deal) in May 2018, and the subsequent re-imposition of US sanctions. The US could turn up pressure on Iran in 2019, raising the possibility of military confrontation, which could be catastrophic for the global economy through the disruption of oil supplies.

Asia/Pacific

Border tensions between North and South Korea are likely to decrease, Fitch Solutions noted, with both countries agreeing to establish no-fly zones and to cease conducting military drills along their border. The main risk is a breakdown of the rapprochement between the US and North Korea. The three countries plan further summits in 2019, but it is unclear whether tangible progress can be made.

In China, meanwhile, President Xi Jinping's abolition of presidential term limits in 2018 and his consolidation of power bode well for structural economic reforms over the coming years. They pose long-term risks, however, to political stability by eroding checks and balances on policymaking. China's worsening ties with the US over trade, tariffs, human rights, and technology continue to be the main challenge. Additional risks stem from the slowdown of China’s economic growth below 6%, and rising tensions with some Asian states over territorial disputes in the East and South China Sea.

Risk management and insurance recommendations

It is vital for companies to appreciate and assess the potential impact of the breadth of political risks they face, as well as the systemic nature of these risks and possible knock-on effects, which often reach far beyond their originating country or sector. It is also important to consider the geographically diffuse nature of many political risks, with G7 nations and other mature economies recently experiencing, and arguably adding to the perception of, an increase in political risk.

Political risks are typically difficult to predict; however, companies can analyze and model risk by clearly quantifying their business operations and pressure points. A company’s mind-set regarding political risk is also important. It is inadvisable to assess any one political risk in isolation, or to perceive political risks in too short a timeframe.

Political risk insurance is part of being resilient against volatility. While political risks are typically not directly controllable, in many instances they can be mitigated through credit and political risk insurance, providing greater confidence in the benefits of the opportunity.

The insurance market for political risks is growing. Insurers have stronger analytical teams and more data, but the breadth of potentially catastrophic risks has increased, as has the perception of what constitutes risk. From an insurer’s perspective, a bigger consideration is often who they are insuring, as much as what they are insuring.

A company’s sector, risk appetite, and experience in the countries it operates in, and its financial and social contribution to those countries, will often be vital determinants of the type of insurance it will be able to secure.

Historically, multinational organizations have purchased political violence and/or terrorism insurance because the rates were typically lower than for political risk insurance, but also because coverage for physical damage is so closely aligned to property insurance. However, this strategy has the potential to leave significant gaps. Political risk insurance can help bridge gaps by including coverage for both perils but, more importantly, by also addressing loss of an investment or contract due to government action or inactivity where there may be no physical damage.

Contracts for the supply of goods and services in emerging countries, with government or private entities, always carry an implied exposure to some underlying political or economic risks. Increased global protectionism, the restriction of hard currency payments to overseas companies, and the imposition of trade embargoes and sanctions are recurring issues in countries where governments attempt to enforce foreign policy objectives, influence domestic public opinion, or manage economic issues. Moreover, companies may find themselves faced with internal counterparty limit constraints that keep them from competing effectively in target markets. Contracts can be covered for terms of up to three to seven years or, if a buyer holds sovereign status, up to 20 years.

Insurance is not a panacea for every risk, but it may enable a company to reduce the uncertainty and volatility around a major contract or investment to protect shareholder interests.

ABOUT THIS REPORT

Drawing on data and insight from Fitch Solutions, a leading source of independent political, macroeconomic, financial, and industry risk analysis, Marsh’s Political Risk Map 2019 presents a global view of the issues facing multinational organizations and investors. This map rates countries on the basis of political and economic stability, giving insight into where risks may be most likely to emerge and issues to be aware of in each country.

Under Fitch Solutions’ method, a country’s score is ranked out of 100 — the higher the index, the less political risk. This report considers the changes in the short-term political risk index (STPRI), a measure that takes into account a government’s ability to propose and implement policy, social stability, immediate threats to the government’s ability to rule, the risks of a coup, and more.