Directors and Officers Liability: UK FTSE 100 Market Update, Q3 2020

Commercial directors and officers liability (D&O) insurance has seen severe pricing increases over the first three quarters of 2020. This has been primarily driven by the increasing uncertainty over COVID-19's long-term impact, and several London market insurers closing their management liability books.

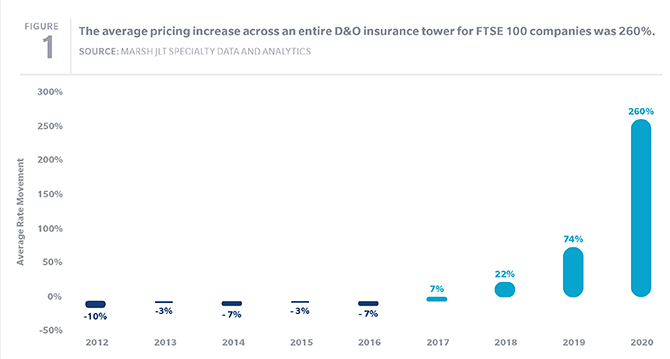

In the first three quarters of 2020, FTSE 100 companies experienced D&O insurance premium increases of 260%, on average (see Figure 1). This dramatic increase is the result of a combination of factors. D&O insurers continue to re-price their portfolios after numerous years of making losses. In many cases, insurers are completely re-pricing risks on renewal, using new rating models, making year-over-year comparisons extremely high.