Exposures Facing Business Development Companies: Regulators, Activist Shareholders, and M&A

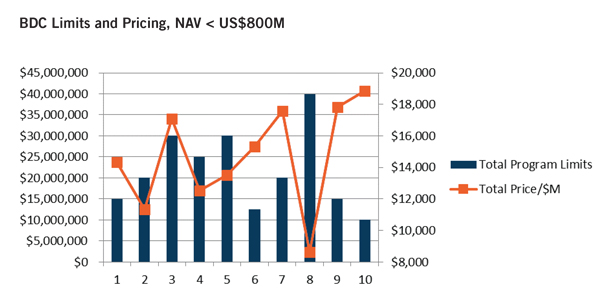

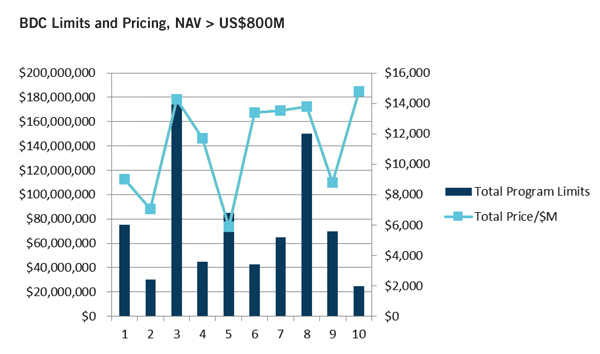

Dechert and Marsh recently released a director and officers liability insurance benchmarking survey for internally and externally managed BDCs.

The survey provides industry participants with information that they can use when reviewing their current insurance programs compared to the industry as a whole.

Survey Results & Key Takeaways

Nearly all BDCs purchase some level of Side A dedicated coverage. Of the survey, the rate per million was significantly higher for BDCs with claims history.

Most BDCs also maintained US$250,000-$500,000 retentions (deductible), while larger BDCs retained the first US$1 million of loss. As the insurance market continues to become less buyer-friendly, we would expect insurers to increase retentions as a first step to improving their profitability.