Deferred Prosecution Agreements: Key Differences Between the US and UK

Deferred prosecution agreements (DPAs) have gained traction in the US and UK in recent years. Both regulators and companies have an affinity for them; such agreements can often resolve legal matters quickly and reduce litigation costs. DPAs can help companies move past questionable actions and avoid the potentially painful and costly spotlight of ongoing litigation and damage to their brand and reputation.

But it is critical to understand DPAs and how they are used — there are significant differences between the US and UK systems that could affect companies and their individual directors and officers. Moreover, businesses would be well served to understand and review how their directors and officers (D&O) insurance may respond when DPAs are used.

What Are DPAs?

A deferred prosecution agreement (DPA) generally is an arrangement reached between a prosecutor and a company to resolve a matter that could otherwise be prosecuted. The agreement allows a prosecution to be suspended for a defined period, provided the organization meets certain specified conditions. A DPA is made with the approval or under the supervision of a judge.

DPAs can be used in potential cases of fraud, bribery, and other economic crime. DPAs have been used in the US for decades, and their use in the UK has been increasing since UK law made them available in 2014. Other countries, including France, Singapore, and Australia, have either introduced or are considering DPAs.

In the US, a DPA carries the risk that a company may be assigned an outside monitor to oversee compliance with the agreement. A DPA also carries the risk of potential suspension or debarment from government contracts by agencies impacted by the problematic conduct covered under the DPA. It is important to assess these risks before signing onto a DPA.

Differences Between Countries

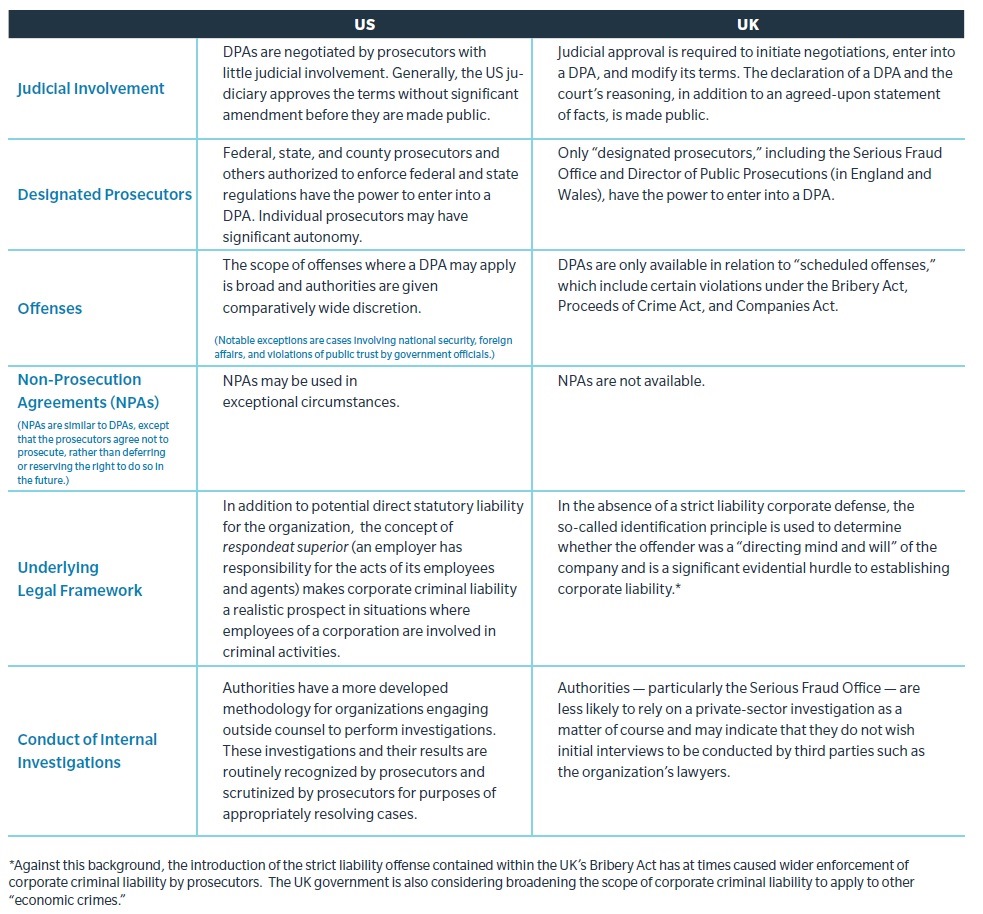

The differences between the US and UK DPA systems can be significant, and understanding those differences can help shape important decisions taken by companies (and individuals) at the early stages of a case and its subsequent investigation.

In the US and UK, DPAs apply to organizations; however, in the US they can also apply to individuals. Although an individual cannot be the subject of a DPA in the UK, the terms of a DPA involving a company can have an important impact on the criminal and civil liabilities of individuals.

Difficult decisions regarding how to structure the investigation and engage with prosecutors need to be made at the outset, when an investigation may be considered by authorities in multiple jurisdictions. These decisions can have a material impact on how individual directors and officers may become involved in the investigation.

Individuals caught up in an investigation — whether administered by their organization, a third party, or a regulator — should consider whether separate legal representation is needed, clarify whether their organization intends to indemnify them, and understand whether their D&O insurance provides affirmative coverage in this instance. The organization should consider these issues as well. Even though the interests of the individual and organization may diverge during the course of an investigation, the need for organizations and individuals to cooperate with authorities throughout an investigation is paramount.

Additional D&O coverage considerations would include the following areas, among others: availability and breadth of pre-investigation cover, internal investigation cover, and formal investigation cover; claims-reporting obligations vis-à-vis confidentiality mandated by the regulator; scope of the insured person definition; and personal conduct exclusionary language.

Difficult decisions regarding how to structure the investigation and engage with prosecutors need to be made at the outset, when an investigation may be considered by authorities in multiple jurisdictions. These decisions can have a material impact on how individual directors and officers may become involved in the investigation.

Individuals caught up in an investigation — whether administered by their organization, a third party, or a regulator — should consider whether separate legal representation is needed, clarify whether their organization intends to indemnify them, and understand whether their D&O insurance provides affirmative coverage in this instance. The organization should consider these issues as well. Even though the interests of the individual and organization may diverge during the course of an investigation, the need for organizations and individuals to cooperate with authorities throughout an investigation is paramount.

Additional D&O coverage considerations would include the following areas, among others: availability and breadth of pre-investigation cover, internal investigation cover, and formal investigation cover; claims-reporting obligations vis-à-vis confidentiality mandated by the regulator; scope of the insured person definition; and personal conduct exclusionary language.